Understanding UK insurance laws and regulations is crucial for all involved in the sector, with key regulators like the FCA setting standards for insurers across pricing, marketing, and claims handling. Consumers benefit from a robust legal framework that protects their rights during claims processes. Insurance policies are comprehensive contracts requiring clear communication and accurate documentation, especially in diverse, multilingual societies, where UK translation services mitigate misunderstandings and streamline claims. Navigating claims under UK policies involves understanding terms, legal obligations, and gathering documentation, with compliance ensuring fair, transparent, and efficient procedures. For international clients, professional translation services are vital for legal compliance, avoiding disputes over complex jargon and diverse legal requirements. Maintaining regulatory compliance is critical to avoid penalties; best practices include staying informed, keeping records, adhering to FCA guidelines, and regularly reviewing policies, leveraging UK translation services to ensure policyholders fully comprehend their rights and obligations.

Staying legally compliant with UK insurance policies is vital to protect both insurers and policyholders. This comprehensive guide delves into the intricate web of UK insurance laws and regulations, outlining key components essential for understanding your coverage. We navigate the claims process, highlight the role of translation services in cross-border policies, and offer best practices for consistent compliance. Essential reading for anyone managing or seeking insurance in the UK, ensuring peace of mind and legal protection.

- Understanding UK Insurance Laws and Regulations

- Key Components of Insurance Policies in the UK

- Navigating Claims Process and Legal Obligations

- The Role of Translation Services in Insurance Compliance

- Best Practices for Maintaining Legal Compliance with UK Insurance Policies

Understanding UK Insurance Laws and Regulations

Understanding UK insurance laws and regulations is crucial for anyone offering or purchasing insurance policies in this jurisdiction. The regulatory framework ensures fairness, protection, and transparency for policyholders and providers alike. Key bodies such as the Financial Conduct Authority (FCA) oversee the industry, setting standards and guidelines that all insurers must adhere to. This includes rules on pricing, marketing, and handling claims, ensuring consumers receive clear information and fair treatment.

The UK’s legal system also has specific requirements for insurance contracts, including provisions related to policy interpretation, exceptions, and limitations. When it comes to claims, understanding the rights and responsibilities of both parties is essential. Insurance policies in the UK are subject to a strict code of conduct when handling claims, which includes timeframes, assessment procedures, and communication standards. Moreover, consumers have access to ombudsman services for resolving disputes, making sure that industry players uphold their legal obligations.

Key Components of Insurance Policies in the UK

In the UK, insurance policies are comprehensive contracts that offer financial protection against unforeseen events. Key components of these policies include coverage, exclusions, and terms and conditions. Coverage refers to what the policy will pay for in the event of a claim, such as damage to property or medical expenses. Exclusions, on the other hand, detail what isn’t covered under the policy, helping to manage expectations and reduce potential disputes during claims processes. Terms and conditions outline the rules and responsibilities of both the insured and insurer, ensuring clarity and legal protection for all parties involved.

Effective insurance policies and claims management are facilitated by professional services, including UK translation services, that ensure clear communication and accurate documentation. Accurate translation is crucial to prevent misunderstandings and misrepresentations, especially in diverse and multilingual societies. These services play a vital role in navigating the complexities of insurance policies, facilitating smoother claims processes, and ultimately protecting individuals and businesses from financial losses.

Navigating Claims Process and Legal Obligations

Navigating the claims process is a critical aspect of ensuring legal compliance with UK insurance policies. It involves understanding both your policy’s terms and conditions, as well as the legal obligations placed upon you when making a claim. Insurance policies in the UK are designed to provide financial protection against various risks, and adhering to the claims process ensures that this protection is accessed effectively. This includes gathering all necessary documentation, providing accurate information, and meeting deadlines for submitting claims.

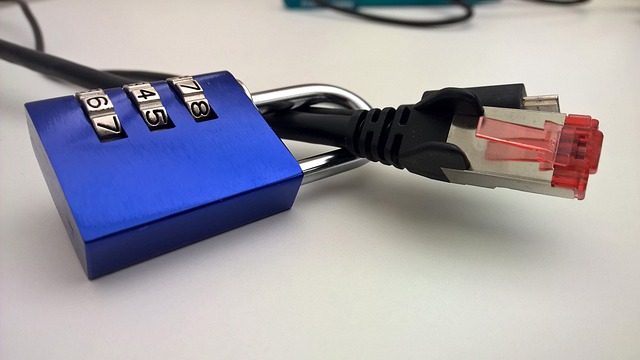

Legal obligations play a significant role in the claims process, as they dictate the steps you must take to pursue a claim fairly and transparently. These obligations often include notifying the insurance provider promptly about any incident or loss, cooperating with their investigations, and ensuring that all communications are accurately translated (using UK translation services if necessary) to avoid misunderstandings. Compliance with these legal duties not only facilitates a smoother claims process but also helps prevent potential disputes or delays in receiving compensation.

The Role of Translation Services in Insurance Compliance

In today’s globalised market, many insurance providers in the UK offer policies to international clients, which necessitates accurate and reliable translation services to ensure legal compliance. With complex insurance terms and specific legal requirements, precise communication is vital to avoid misunderstandings and potential disputes. Professional translation services play a crucial role in navigating these intricacies by providing clear and concise interpretations of insurance documents, including policies, claims forms, and contract terms.

These services enable non-native English speakers to fully comprehend their insurance coverage and rights, facilitating smooth claims processes. Accurate translations are essential for maintaining compliance with UK regulations, as they help prevent errors and ensure that all parties involved have a clear understanding of the policy’s scope and conditions. By leveraging translation expertise, insurance companies can offer superior service to their global clientele, fostering trust and confidence in their policies and claims procedures.

Best Practices for Maintaining Legal Compliance with UK Insurance Policies

Maintaining legal compliance with UK insurance policies is paramount for businesses and individuals alike to avoid hefty fines and potential legal repercussions. Best practices involve staying updated on regulatory changes, keeping detailed records of all policyholders and their respective coverage, and ensuring that all communication related to claims adheres strictly to the rules set by the Financial Conduct Authority (FCA). Regular reviews of existing policies are crucial to identifying gaps in coverage and updating them accordingly.

Additionally, leveraging UK translation services for insurance documents can mitigate risks associated with miscommunication. Accurate translations ensure that policyholders fully understand their rights and obligations, enhancing trust and reducing the likelihood of disputes. This is especially important given the diverse linguistic landscape in the UK, where clear and concise communication in multiple languages can be a game-changer during claims processes, ensuring smooth interactions and faster resolution.

Ensuring legal compliance with UK insurance policies is paramount for both insurers and policyholders. By understanding the key components of these policies, navigating the claims process efficiently, and leveraging professional translation services for multilingual coverage, businesses can effectively manage risks and protect their interests in the competitive UK market. Adhering to these best practices fosters trust, reduces legal complications, and ultimately strengthens the integrity of the insurance sector.